image credit theblaze.com

Hyperinflation and a financial collapse may be merely months away in the United States, according to a financial consultant and Columbia University professor.

Bottom Line Training and Consulting Founder and CEO David Buckner says that although the United States has not yet experienced hyperinflation, such an economic disaster could be just around the corner. Buckner is also a Columbia University professor and the author of the book, Permission to Think. The fiscal guru believes that by October of 2014 or January of 2015, interest rates will increase sharply and kick off a dire domino effect in the economy.

When the topic of hyperinflation is discussed, countries like Greece, Bolivia, and Zimbabwe come to mind – not America. The economic collapse in Germany’s Weimar Republic during the 1920s resulted in Marks losing their value rapidly as panic set in due to hyperinflation.

According to Buckner, hyperinflation has never happened in the United States because a “certain kind of layering” would first have to occur.

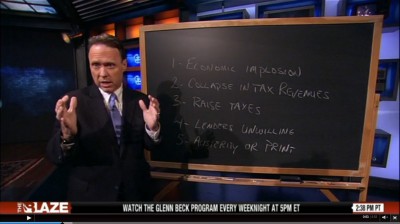

Buckner’s “Layering Recipe for Hyperinflation”

- Economic Implosion

- Collapse in tax revenues

- Tax increases

- Unwilling lenders

- Austerity

During the author’s chat with Glenn Beck, he noted that while some Americans think all the steps in the hyperinflation recipe have already occurred, others believe that three specific attributes of our economy will prevent the nation from falling victim to a fiscal collapse. In each instance, Buckner said, defenders of the current system are wrong.

New book reveals gold-buying secrets that dealers don’t want you to know about…

First, those who refuse to believe an economic collapse could happen in America reportedly feel that since “everyone want to buy our debt,” we are protected from a hyperinflation scenario. The perceived never-ending willingness to buy American debt should not be counted upon, said David Buckner. The fiscal expert noted that China is currently turning its purchased United States’ debt into gold.

Second, he said according to The Blaze, some say “we’re not printing money” because “we’re exchanging an asset – a bond – for cash.”

“What they’re not saying is where that bond’s coming from – treasuries,” David Buckner said. “As soon as the government puts it out there, the Fed comes and takes it. It’s circular, it’s absolutely circular. So we are printing money.”

Third, some say America will remain strong because it is a productive country. But so many of America’s top companies – such as Apple – rely on products made overseas, he said.

“And everybody says, well you’re not seeing hyperinflation,” Buckner said, but he said that’s because “the interest rates are so low, nobody’s putting that cash back into investments in the United States. But they are putting it into desperate countries in Europe. They’re putting it into other investments. And the money’s going out there, so the second Bernanke raises the interest rates, all of the sudden the money sucks back into the United States and we have hyperinflation.”

Glenn Beck asked David Buckner what type of event would trigger an economic meltdown.

“We’ve had an event, but … we’ve become comfortably numb,” Buckner said. “So there’s been a lot of hidden stuff that’s going on. The treasuries continue to go out, and Bernanke continues to buy debt. [But] anytime he starts to back off the markets freak out, because they know. The markets know. But we don’t, the people don’t. People who are retired, pensioners, elderly, people who are holding money are going to be devastated.”

Federal Reserve Chairman Ben Bernanke is printing approximately $85 billion per month, according to a Yahoo Finance report. That amount is equal to 6 percent of the annual GDP. The report on the activities of the Federal Reserve also stated that Bernanke is spending the printed dollars on government bonds in order to stimulate investment, keep interest rates low, and reduce the amount of unemployment. The financial review does not think Bernanke’s plan is working. According to the article, investments are still very low, interest rates are creeping back up, and unemployment statistics remain unpleasant.

“Bernanke’s dangerous policy hasn’t worked and should be ended,” the report said. “Since 2007 the Fed has increased the economy’s basic supply of money [the monetary base] by a factor of four. That’s enough to sustain, over a relatively short period of time, a four-fold increase in prices. Having prices rise that much over even three years would spell hyperinflation.”

Buckner’s company has trained thousands of managers and executives from more than 50 different countries.

Once the dominoes start falling, how long will the collapse take?

“Three months,” Buckner said. “You listen to many of the economists — within three months. And it’s going to be perception more than real price. You’re going to see hoarding, you’re going to see fear. It’s not the actuality. So if they can put a glaze over everybody…it’s may slow it down. That’s the problem, is we’re dealing with an illusion. It’s an illusion of what is real. We don’t have the money. So the interest rates go up, you’re going to see a domino.”

Do you think hyperinflation could occur in the United States and prompt an economic collapse?

Off The Grid News Better Ideas For Off The Grid Living

Off The Grid News Better Ideas For Off The Grid Living