|

Listen To The Article

|

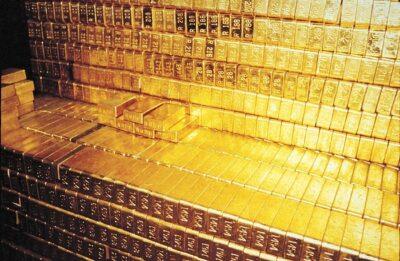

Image source: Forbes

The Chinese government could be positioning itself to dominate the world’s gold market and use its bullion to make its yuan currency the basis of international trade. At least that’s speculation from financial analysts after it was revealed that China is now the world’s largest gold importer.

“[Chinese] authorities may possibly be moving in the direction of using gold in a plan to make the yuan an international currency,” CNBC reporter Dhara Ranasinghe wrote, adding that financial analysts at Lombard Street Research believe China’s increased gold imports indicate that officials there want to use gold to prop up a shaky currency.

Such speculation is being fueled by rumors that the People’s Bank of China (the Chinese equivalent of the Federal Reserve) is secretly buying up large amounts of gold on the international market. The People’s Bank claims that it hasn’t bought any gold bullion since 2009 but experts say figures on Chinese gold imports indicate the bank is buying.

There is also some speculation that the People’s Bank could be planning to switch to a gold standard in an attempt to protect China’s economy from the collapse of the US dollar. The dollar is the world’s reserve currency and the basis of international trade. The Chinese reduced their holdings of US Treasury securities by 3 percent between November 2013 and March 2014.

The Mystery of China’s Gold Imports

A number of analysts noted that figures reported by the China Gold Association contain a big discrepancy. The latest stats show that China imported 500 more tons of gold in 2013 than industrial demand would justify, analyst Na Liu of CNC Asset management told The Financial Times.

New book reveals gold-buying secrets that dealers don’t want you to know about…

“But the latest official figures show that China imported and produced far more gold in 2013 than its citizens bought,” Financial Times writer Simon Rabinovitch said. “This chasm suggests that the central bank was a buyer in the gold market last year in spite of its protestations to the contrary, say analysts.”

A ton of gold was worth around $39 million on July 7, 2014, according to onlygold.com. Therefore the 500 additional tons of gold would be worth around $19 billion.

Image source: Bloomberg

Most of the analysts think the People’s Bank is engaged in clandestine gold buying. Forbes contributor Shu-Ching Jean Chen even speculated that the People’s Bank is maintaining secret underground vaults to store the gold.

Far more gold could also be stored in commercial banks in China. Around 12 commercial banks in the nation have licenses to import gold. These banks don’t have to report how much gold they buy, so they might be used as covers for gold imports by the People’s Bank or the Chinese Communist Party.

China’s official gold reserves are around 1,054 tons, according to estimates, and its demand for gold is growing.

China’s Insatiable Demand for Gold

Figures from the China Gold Association show that China is now the world’s largest importer of the precious metal. The figures include:

- Chinese gold imports have more than doubled since 2012.

- Chinese gold imports increased by 41 percent in 2013.

- China has replaced India as the world’s largest importer of gold.

Some observers believe the Chinese could be planning to use gold to shore up their currency, as some analysts say the yuan is overvalued.

Are Both US and Chinese Currencies on Shaky Ground?

“Not only does [yuan] overvaluation make it directly sensible for Chinese investors to dump the currency in favor of gold, it also brings Chinese liabilities into question in general,” Lombard Street Research economist Freya Beamish told CNBC. Beamish thinks Chinese investors are planning to use gold as a hedge against the collapse of their currency.

“With the [yuan] this overvalued, China now seems incapable of growing without debt injections and that is a situation that can only end in crisis or [yuan] depreciation or some combination thereof,” Beamish noted. A collapse in the yuan could seriously damage the US economy because China is a major market for US exports. “Gold is a natural hedge in any of those scenarios.”

A gold-backed yuan could easily replace the dollar as the reserve currency, economist Robert P. Murphy noted. Murphy thinks a sudden collapse of the dollar could occur and that the People’s Bank might be preparing for that contingency.

The Chinese reduced holdings of US Treasury securities by 3 percent between November and March, Murphy noted. Murphy believes that a large scale sell-off of US Treasury securities by the Chinese could cause the dollar to collapse.

Americans should pay attention to China’s gold purchases, as they could be an indication that the People’s Bank leaders believe a major economic upheaval is imminent.

Why do you believe China is buying so much gold? Tell us in the comments section below.

Sign up for Off The Grid News’ weekly email and stay informed about the issues important to you

Off The Grid News Better Ideas For Off The Grid Living

Off The Grid News Better Ideas For Off The Grid Living