|

Listen To The Article

|

The market has proven that gold is not the ideal investment that some people thought it was. The precious metal lost around $230 in value in the April 12 and 15 trading sessions. It rallied slightly on April 16, but its price of $1,386.50 a troy ounce was still a far cry from the $1,787 an ounce the metal was trading at in September.

So what’s going on here? Is it a complete collapse of the gold bubble or simply the market correcting to a more realistic price? That question will be difficult to answer until we see where gold prices actually go. The most likely scenario is that speculators are simply dumping gold to buy stocks because of the great performance of the S&P 500 lately.

As speculators that purchase gold futures for short-term gain get out, the prices will fall. Another problem is that big investors such as hedge funds are betting against gold. When a bubble develops in today’s economy, big-time speculators such as George Soros often bet against it, which can make the situation much worse.

Many gold bugs (serious gold investors) are betting on a total collapse of the economy. History tells us that has never happened in our history, even during the Great Depression or the Civil War. Barring a massive catastrophe, such as a nuclear war, total economic collapse isn’t likely to happen. In such a situation, you’ll have more important things to worry about: namely, just surviving any way you can.

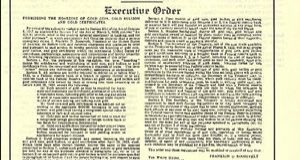

The more likely scenario is a partial collapse of the economy as we saw happen in 2008 and in 1929. Something else to keep in mind was that people who bought stocks during the Great Depression were better off than those who owned gold. During the Depression the federal government seized gold and made its ownership illegal but didn’t ban stock trading. So persons with money in stocks kept their cash even though they had to wait until after World War II for the markets to recover.

The more likely scenario is a partial collapse of the economy as we saw happen in 2008 and in 1929. Something else to keep in mind was that people who bought stocks during the Great Depression were better off than those who owned gold. During the Depression the federal government seized gold and made its ownership illegal but didn’t ban stock trading. So persons with money in stocks kept their cash even though they had to wait until after World War II for the markets to recover.

Central Banks and the Price of Gold

There are many factors and forces affecting the price of gold that average people don’t think about. Among the biggest is central banks such as the Bank of England, the Bank of Korea, the People’s Bank of China, and the U.S. Federal Reserve System.

Central banks often buy gold when the price falls, and they hold large reserves of it. Large investment banks and hedge funds also buy up or hold huge amounts of gold futures. Much of the present drop in gold was triggered by the super investment bank Goldman Sachs, which is advising its clients to sell gold.

One reason why gold prices are falling is that large buyers like central banks are staying out of the gold market because prices are so high. If prices fall below a certain level—probably $1,000 a troy ounce—expect many big buyers to jump back into the gold market.

Obviously, the high prices motivate many large owners of gold to sell in order to cash in. Large-scale investors have everything to gain by selling while prices are higher because they can simply buy the gold back when the price falls.

New book reveals gold-buying secrets that dealers don’t want you to know about…

Other Forces Affecting Gold Prices

There are several other forces that affect the price of gold that most people are not aware of. The biggest of these is the economy of India, the world’s largest gold market, which hasn’t been doing that well lately. People in India are the world’s biggest buyers of gold, and they simply haven’t had the money to buy gold in recent years.

The Indian economy, like the U.S. economy, is improving slightly, but it still isn’t doing that well. Another problem is that a lot of Indian investors have had to sell off all or some of their gold, which also drives down the prices. A new tax on retail gold in India—jewelry is the preferred gold investment there—also hurt sales.

Economic problems elsewhere, including Europe and China, also hurt the price of gold by forcing people to sell it off. China could really hurt the gold market because gold coins and jewelry are among the few things middle class Chinese can invest in under their current laws. Any big selloff in China or India can seriously damage the gold market.

The High Cost of Gold Mining

Also affecting the gold market are big mining companies such as Newmont Gold, Freeport-McMoRan, Rio Tinto, Barrick Gold, and BHP Billiton, which hold huge stocks of gold. These companies have been raising production lately, which affects the price. Also affecting the price is that mining costs have been going up while prices for metals like copper and silver have been falling. Big miners might be forced to sell gold in order to cover costs.

One reason why mining costs are up is that most of the big miners have been undertaking major expansions lately, developing huge new mines. This increases the supply and drives down the price. Mining costs are being driven up by rising fuel costs and labor costs in countries like Indonesia. Mining companies have to sell more gold just to stay in business.

Gold mining is now so volatile and costly that some companies, like Freeport-McMoRan, are moving into other areas such as oil and gas exploration. That’s hardly a sign that gold is a safe haven.

The Black Market in Gold

Finally, there is the growing and thriving black market in gold, which is huge but poorly understood. The Assistant Governor of the Central Bank in the Philippines estimates that 95 percent of the gold mined in that country is sold to smugglers.

Illegal gold mining is popular in many nations because of high taxes, government control over mineral resources, and environmental restrictions. In many countries, there is little or no control over small-scale mining. The problem is that black market gold finds its way into the legitimate market sooner or later and affects prices there. Illegal gold affects prices because it means the gold supply is much larger than officially estimated. A larger supply means lower prices and a more volatile market.

Illegal gold mining is now big business and hard to control because it’s a popular source of revenue in many countries. Organized crime has moved into illegal gold in a big way. Criminals like gold because it is easy to disguise it by melting it down. Illegal gold mining is now so profitable that Colombian cocaine cartels are now using it as a major source of revenue. Illegal gold mining is also used to fund the activities of Communist guerrillas and warlords.

What all this means is that the price of gold is far more volatile than you thought. Instead being a safe haven or a cure for economic problems, gold is part of the problem, so you should be very careful with it.

Should Average People Own Gold?

Not surprisingly, many preppers and other average people are asking the question: Should I own gold right now? The best answer to this question is that you should own some gold, but you shouldn’t put all of your money in gold because it, like any other commodity, is vulnerable to market forces.

The best strategy is to have a small portion of your income invested in precious metals. Putting a few dollars in gold or silver ETFs or having a small stash of gold coins is okay. Having most of your funds in gold is a bad idea because of its vulnerability to the market. A balanced and diverse portfolio is always the best call.

Off The Grid News Better Ideas For Off The Grid Living

Off The Grid News Better Ideas For Off The Grid Living