screenshot

Despite all the hype about the budget battle and sequestration cuts in Washington, federal spending is still completely out of control. The Heritage Foundation now estimates that federal spending has increased by 40% since 2002.

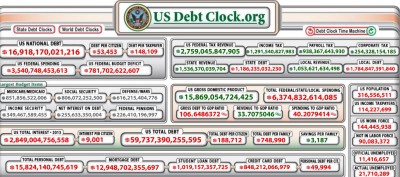

The growth in spending will create a federal debt of $17 trillion within four years, the Heritage staff estimated. That debt will be larger than the gross domestic product, or GDP, of the United States. The GDP is the value of all the goods and services produced in the United States.

National Debt Staggers the Imagination

To give an idea of how large the debt will get, the U.S. GDP in 2013 was estimated at $14.99 trillion by the World Bank. If you compare the World Banks’ GDP figures and the Heritage Foundation’s debt estimates, the U.S. national debt will actually exceed the gross domestic products of China and Japan combined. In 2013 China had a GDP of $7.318 trillion, and Japan had a gross domestic product of $5.867 trillion.

The United States is well on its way to generating an incredible amount of national debt. The Heritage Foundation estimated that the national debt level is close to that in the mid-1940s, right after World War II. To accumulate that much national debt, the U.S. had to finance its war efforts and the war efforts of the entire British Empire (the UK, India, Australia, and Canada) and the Soviet Union.

The U.S. will soon accumulate several times as much debt as it did during World War II, despite all the promises of reducing the national debt and controlling spending. Washington has essentially become a debt factory.

Spending Exceeds Revenues

The reason for this is obvious; in 2013 Uncle Sam will spend $3.5 trillion but only collect $2.8 trillion in taxes. The difference between the spending and the taxes is the national deficit; it currently comes to $642 billion.

For Those Who Desperately Want Out Of The Rat-Race But Need A Steady Stream Of Income

The problem is that spending is growing at a far greater rate than revenue. The Heritage Foundation estimates that federal spending will grow by 69% over the next decade. The reason for most of this growth will be automatic increases to programs like Social Security, Medicare, and Medicaid. Those increases are mandated by law.

Even more automatic spending will be added by Obamacare, which will cost $1.8 trillion by 2023. Healthcare will become the biggest item in the federal budget by 2015, just a year after Obamacare kicks in.

Obamacare Fiscal Nightmare

Spending on these programs is growing for several reasons, including the dismal economy, which makes many families dependent on entitlements; the aging population, which increases the number of people on Medicare and Social Security; and out-of-control medical costs.

Part of the problem is that Obamacare does little or nothing to lower medical costs while increasing the number of people in programs like Medicaid. It also creates a vast new bureaucracy in the form of health insurance exchanges, the cost of which will be unknown. The Heritage Foundation estimates that Obamacare will cost $1.8 trillion by 2023.

Since we don’t know what the exchanges will cost or how many people will sign up for them, it is impossible to estimate the potential cost. The exchanges are supposed to be for low income people, but The Washington Post discovered that the federal government has no means of determining the income of applicants. That means large numbers of middle class people can sign up for them.

Notice that no effort was made to add the kind of taxes needed to pay for Obamacare. Another potentially popular mandate has been added to the budget, yet no means of paying for it has been devised.

Other kinds of spending are increasing as well; the Heritage Foundation noted that federal spending on energy has increased by 2,000 percent since 2002. This spending includes everything from nuclear reactors to green technologies.

Why Is This Happening?

The reasons for out-of-control spending in Washington go far beyond a lack of fiscal or political discipline. A big motivator for federal debt is the huge profits made in the market for U.S. Treasury bonds.

Investors sold $54.46 billion in treasury notes and bonds in April 2013 alone. That’s a huge market that lots of people profit from, including Wall Street, big banks, investment banks, hedge funds, private individuals, speculators, and foreign governments. All of those individuals and entities have a vested interest in keeping a massive federal deficit around to profit from.

Every time a treasury bond gets sold or resold, a broker or an investment banker somewhere makes money. The more debt, the more money Wall Street and its counterparts overseas make.

Naturally, politicians wouldn’t admit that the real reason they’re driving up spending is to help investment bankers make more money. Congress and the president are now operating for the benefit of financiers and speculators rather than the American people.

Will It Lead to Disaster?

Many people are probably wondering whether this debt-based government and economy can last or not. The scary answer is that we really don’t know. Conventional wisdom would say no, especially with the collapse of other debt economies like those in Greece and Ireland.

By constantly increasing spending and growing the national deficit to epic proportions, the politicians are engaged in an unprecedented economic experiment. No political entity in history has amassed the kind of debts the United States is collecting, nor has any government ever sustained that level of spending.

This experiment makes the U.S. economy hostage to the bond and securities markets. Markets, as we all know, are erratic and vulnerable to massive collapses in value; remember the stock and real estate markets a few years ago. If the bond market were to collapse, the federal government would have no way to cover the deficit.

Congress would have to drastically slash spending or greatly increase taxes to make up the difference. That could lead to political upheaval and possibly civil unrest in the U.S.

Those Americans who are relying upon programs like Social Security or plan to do so in the future might consider looking into alternatives. Out-of-control federal spending could soon lead to complete disaster.

Off The Grid News Better Ideas For Off The Grid Living

Off The Grid News Better Ideas For Off The Grid Living