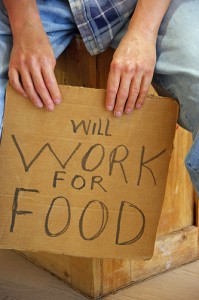

“America’s going to go through a transition the likes of which no one is prepared for,” said Gerald Celente, CEO of Trends Research Institute. Credited for predicting the 1987 stock market crash, the fall of the Soviet Union, the 1997 Asian Currency Crisis, and the subprime mortgage crisis of 2008, Celente says that by 2012, America will become an “undeveloped” nation, prone to food riots, rebellion, revolt and marches, and that the year’s holiday season will be more about “putting food on the table [than] putting gifts under the Christmas tree.

“America’s going to go through a transition the likes of which no one is prepared for,” said Gerald Celente, CEO of Trends Research Institute. Credited for predicting the 1987 stock market crash, the fall of the Soviet Union, the 1997 Asian Currency Crisis, and the subprime mortgage crisis of 2008, Celente says that by 2012, America will become an “undeveloped” nation, prone to food riots, rebellion, revolt and marches, and that the year’s holiday season will be more about “putting food on the table [than] putting gifts under the Christmas tree.

“But could food shortages really happen in the United States? There have already been food riots in Malaysia, Sudan, Senegal, Somalia, Egypt, pre-quake Haiti, Pakistan and India, with worries for Indonesia, Thailand and the Philippines – in fact, there have been food riots on every continent, according to the Council on Foreign Relations, except North America and Australia.

As fuel prices rise, affecting costs from fertilizer to transportation, farmers in poorer countries with smaller profit margins are forced to produce less. They don’t have the option to switch crop land to a non-food commodity, such as corn for ethanol production, because they spend more of their per capita income on food (50-60%) than people in more industrialized nations(10-20%) so they can only afford food grown locally. Switching to a commodity for non-food production would drive food prices higher. Also, many developing countries lack commodities markets that would allow them to profit from rising corn or wheat futures, so there is less financial incentive, and their production levels are rarely large enough to permit future speculation.

Most cynically viewed, these markets allow the rich to profit while the poor, quite literally, starve.

It appears that crop conversion to non-food corn can only happen in modernized countries such as the United States and Germany. It then becomes conceivable that as food shortages occur in other countries, they will prohibit food exports in order to meet domestic needs, as Kazakhstan did when they stopped selling wheat in May of 2008. Just the announcement in February caused global wheat prices to jump 25%.

Combine this with more frequent and devastating natural disasters, add the booming 8.9 billion global population expected by 2012, and you have an environment ripe for aggressive price inflation.

Finally, add the worldwide trend towards increasing meat consumption, which requires more grains to feed farm animals. It then becomes believable that if the dollar falls in value–which, according to Celente, it will, by 90%–the United States will suddenly be spending the same amount of income on food as the non-industrialized nations. Also known as … a food shortage. The only question would then be, how hungry does one have to be to riot?

Off The Grid News Better Ideas For Off The Grid Living

Off The Grid News Better Ideas For Off The Grid Living